By Christos Chiou, Head of Finance, DataScouting

DeepFinance is a research proposal that DataScouting, in partnership with SpeedLab GmbH, and the School of Informatics of the Aristotle University of Thessaloniki, submitted in late 2019. The proposal has been accepted, turning DeepFinance into a working project since mid-2020.

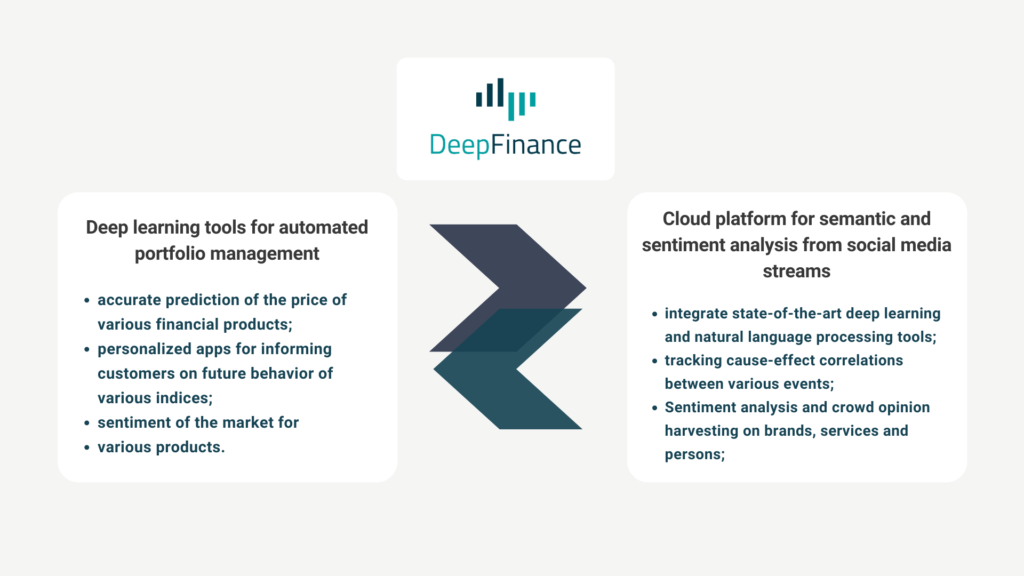

Co-financed by national funds (Operational Programme Competitiveness, Entrepreneurship and Innovation 2014-2020/EPAnEK, and the National Strategic Reference Framework/NSRF), and EU funds (European Union, and the European Regional Development Fund), DeepFinance aims to develop a complete platform for semantic and sentiment analysis from social media streams using deep learning. This platform can be then used to further develop unified tools for financial portfolio management that can effectively fuse multi-modal information that is extracted from various sources (including social media streams).

More specifically, within the context of DeepFinance, DataScouting and its partners aim to:

- develop deep learning tools for automated portfolio management, in order to achieve better performance compared to the currently used strategies that mainly consist of handcrafted decision rules;

- develop a platform for semantic analysis of social media streams, e.g., twitter, blogs, etc., in order to provide semantic and sentiment analysis services for specific stocks, financial indices and so on; and

- integrate the semantic and sentiment analysis services from DataScouting into the existing products of SpeedLab, in order to develop new portfolio management products that take into account information that can be extracted from social media, regarding the market’s sentiment.

Such a project provides a solid step towards advanced and competitive products for deep learning-based financial analysis and portfolio management, that can be effectively exploited by SpeedLab, and also the opportunity for DataScouting to develop an innovative and ground breaking product, through which it will provide cloud services for semantic and sentiment analysis of data harvested from social media streams for financial purposes.

We asked Stergios Chairistanidis, ΑΙ Engineer/Quantitative Developer at Speedlab, and Stavros Doropoulos, CIO at DataScouting about the primary objective and expected outcomes of DeepFinance.

Q: Regarding DeepFinance, how exciting is the prospect of such an addition to your system and range of products?

Stergios Chairistanidis: DeepFinance is a tool that will surely add value to our company and it will enhance our trading methods. Having a platform that will allow us to identify the trends in various social media and news sources makes the algorithm’s predictions much more accurate. Also, it would allow the portfolio manager to have a more concrete knowledge of the universal sentiment about different trading products and make the decisions she has to take easier.

DeepFinance platform will allow the company to grow beyond traditional quantitative trading and will make use of the huge computer power that exists nowadays. For the developers of our company, the ability to have access and use extra datasets of information around trading, will allow them to make the AI systems even smarter and more generalized and even learn new ways of trading that a human brain could not easily conceive.

Q: Considering the exponential growth of public information and opinion, its reach and speed of dissemination particularly via social media, as well as the unpredictability of international politics and economics during the past decade, would you say that tools such as the DeepFinance platform are becoming a necessity in the context of contemporary markets, financial or other?

Stergios Chairistanidis: With the exponential growth of publicly available information, getting as much such data as possible is your best chance in order to compete in such markets. Nowadays, everyone can have access to such information and leverage it to make better decisions concerning his target, either this is a better trading system or a more detailed and correct decision concerning problems arising in their fields. Also, it is of utmost importance today to be able to act as quick as possible based on news arising around the world. Such trends, which take the form of an avalanche in news sources around the world in a matter of seconds, are highly important to a trading system, since such a system should be able to react instantly after such an event (financial opportunity) arises. So basically, such a system minimizes the risk of such events that occur and are highly unpredictable, so the investors should feel more comfortable and less wary about their investment.

Technologically, we are already using the latest advancements in AI which we have developed in house in collaboration with the Aristotle University, and the ability to use this new form of data (tweets, newsfeed, etc.) will allow our systems to become even better and comparable to the other systems that are state of the art right now worldwide. Such a technological achievement will render our company one of the innovators in the field of algorithmic trading and will give us the edge compared to the other competitors.

Q: What are the main ambitions and challenges regarding DeepFinance, from DataScouting’s perspective? What is the project’s success contingent upon, in your opinion?

Stavros Doropoulos: DeepFinance is based on the assumption that sentiment expressed in social media is a projection of the underlying financial trends, especially regarding retail investors. Combining data ingestion with machine learning-enabled metadata augmentation is a time-proven workflow used by DataScouting to deliver insights and enable decision making.

That being said it is important to understand the exact scope of this project regarding the massive scale of the data to be processed, the targeting of the social media sources, accounts and keywords via domain experts and active learning, the different output granularities needed and many other parameters that require fine tuning during the training but also during the evaluation phase of the project. The processing speed will need to match the real time nature of the problem, as recently demonstrated by social trading examples, such as the GameStop stock price rally, and the cryptocurrencies bull market, which sometimes originates from a single tweet, while at the same time dealing effectively with heterogeneous sources. DataScouting will produce a state of the art web and social media sentiment and semantic analysis platform to be used across different vertical markets, and that will be customized for the project’s use-case.

Q: The research and development operations within DataScouting have been growing. Would you like to share a few words about the quantities and qualities of this growth, what it contributes to business, and your personal experience of being a part of it?

Stavros Doropoulos: DataScouting, as our name suggests, was always about extracting actionable information from data. Since our beginning it was clear to us that we needed to follow a multi-modal approach to automated metadata extraction for several domains such as media monitoring and cultural heritage. This is the reason why we have invested in the development of modules that are able to process, analyze and extract information from audio, image (video) and text with processes that range from Automatic Speech Recognition, Advertisement Detection/Audio Fingerprinting, Logo/Object/Face Recognition, customized Optical Character Recognition, image and video Semantic Analysis to Entity detection and other Natural Language Processing outputs.

I have personally witnessed the transition from having these modules perceived as “nice-to-have” features of our platforms to being a necessity and a catalyst for changing the everyday workflow of annotators, analysts, researchers and other end users of our customers. This is especially true because the above problems are not being approached with generic models but instead we create custom tailored models, trained using large amounts of in house annotated data and thus delivering models with high accuracy. Personally, I am blessed to work with an exceptional team who, including me, are lucky enough to have transformed our hobbies into careers and who are given the tools and opportunities to turn ideas and research deliverables into enterprise software solutions.

DeepFinance is projected to reach completion around January 2023. As there is work to be done for the vision to unfold into reality, into a functional platform that can offer insight and (why not?) accurate predictions about the behavior of financial markets, positivity and good work ethic are evident in the context of this team effort. WIth high-level expertise and a good understanding of the developments in markets and the media monitoring industry involved, all partners are in high spirits and eager for the upcoming results.

About Stergios Chairistanidis

Stergios Chairistanidis received his B.Sc. degree in electronics/information technology from the Hellenic Airforce Academy, Attica, Greece, in 2008, the B.Sc. degree in computer science and applied economics from the University of Macedonia, Thessaloniki, Greece, in 2013, and the M.Sc. degree in management and informatics from the Aristotle University of Thessaloniki, Thessaloniki, in 2016. He is currently an ΑΙ Engineer/Quantitative Developer at Speedlab AG, Cham, Switzerland, and he is responsible for creating and deploying Reinforcement Learning Agents that can perform trading actions in various financial assets.

About SpeedLab AG

SpeedLab AG was founded in 2014 in Cham, Switzerland with a sales subsidiary, SpeedLab GmbH that is located in Munich, Germany and an R&D subsidiary that is located in Thessaloniki, Greece. Speedlab is an investment management firm (SRO- and BOVV-Member of VQF Switzerland) trading in many asset classes , dedicated to delivering exceptional returns for our clients strictly using Artificial Intelligence. Speedlab AG has strong Institutional Partnerships as the Shareholders list contains among others a Private Bank , a Venture Capital and a family office.

Speedlab provides Institutional clients with hedge fund products based on SpeedLab’s AI quantitative investment processes as follows:

- Dedicated manage accounts for fx, Bonds/ Indices futures, Cryptos

- Tailor made AMCs

- Strategy overlay to existing UCIITs funds

- Strategy overlay to hedge funds

Our custom tailored SpeedLabTM SAAS-fund solutions can be specifically engineered according to a client’s risk appetite and performance requirements. Our clientele includes private banks, family offices and high net individuals and over 70mio CHF Assets under management. (AUM)

About Stavros Doropoulos

Stavros Doropoulos is a graduate of the Department of Computer, Informatics and Telecommunications Engineering of The International University of Greece. He holds an MSc degree on Digital Media-Computational Intelligence of the School of Informatics of the Aristotle University. His research interests lie in Deep Learning, Image Analysis, Natural Language Processing and Data Mining. Currently, Stavros holds the position of CIO at DataScouting having long experience in running and managing IT projects. He is the founder of the Thessaloniki Machine Learning Meetup and is involved in the Greek startup community. He is a frequent speaker at conferences and runs workshops, for members of his team and clients.

About DataScouting

DataScouting is a service provider and software developer for Information and Communication Technologies (ICT), specialized in developing innovative solutions for media monitors, PR agencies, publishers, broadcasters, brand owners and market analysis specialists. Using technologies such as Optical Character Recognition, Natural Language Processing, Automatic Speech Recognition, Logo Detection and Data Mining, DataScouting provides intelligent solutions for managing and delivering of print, broadcast, online and social media. Our MediaScouting platforms are designed to track news, monitor advertisements, identify logos and comes as a 360-degree solution with archiving, multi-form delivery, reporting, alerting, and a dashboard for easy access anywhere, anytime. DataScouting can help you accelerate business grown and address business and technology challenged by designing and building high quality, reliable and secure applications tailored to meet your business requirements. DataScouting is a member of FIBEP, AMEC, and NEM.